2 CARA CEK NISN KU SECARA ONLINE BERDASARKAN NAMA DAN NISN

2 CARA CEK NISN KU SECARA ONLINE BERDASARKAN NAMA DAN NISN

Pengertian NISN

Sebelum kita mencari NISN siswa ada baiknya kita ketahui apa itu NISN. NISN yaitu abreviasi dari Nomor Induk Siswa Nasional. NISN yaitu instruksi pengenal identitas siswa yang bersifat unik, standar dan berlaku untuk sepanjang masa yang sanggup membedakan antara satu siswa dengan siswa lainnya di seluruh sekolah-sekolah Indonesia dan juga Sekolah Indonesia yang berada di Luar Negeri; Nomor Induk Siswa Nasional (NISN) diberikan kepada setiap peserta didik yang bersekolah di satuan pendidikan yang mempunyai NPSN dan terdaftar di Referensi Kemendikbud. NISN terdiri dari kombinasi angka unik yang terdiri dari sepuluh angka yang diberikan oleh setiap kepada siswa mulai dari SD, SMP, dan SMA. cek nisn

Selain itu NISN juga mempunyai sifat permanen alias angka tersebut tidak akan berubah dari jenjang pendidikan SD sampai SMA. NISN biasanya dipakai sebagai salah satu persyaratan dalam registrasi peserta didik gres dan juga penerimaan siswa pindahan dari sekolah lain. Terkadang, NISN juga berfungsi untuk penerimaan rapor hasil berguru siswa. dan perlu diketahui juga NISN ini hanya berlaku selama pemegang NISN masih berstatus sebagai siswa. cek nisn

Tujuan dan Manfaat NISN

Tujuan & Manfaat NISN antara lain :

1. Untuk Mengidentifikasi setiap individu siswa (peserta didik) di seluruh sekolah se-Indonesia secara standar, konsisten dan berkesinambungan.

2. Sebagai sentra layanan sistem pengelolaan nomor induk siswa secara online bagi Unit unit Kerja di Kemendikbud, Dinas Pendidikan Daerah sampai Sekolah yang bersifat standar, terpadu dan akuntabel berbasis Teknologi Informasi dan Komunikasi terkini.

3. Sebagai sistem pendukung aktivitas Dapodik dalam berbagi dan menerapkan program-program perencanaan pendidikan, statistik pendidikan dan aktivitas pendidikan lainnya baik di tingkat pusat, provinsi, kota, kabupaten sampai sekolah, seperti: Bantuan Operasional Sekolah (BOS), Ujian Nasional, PIP, SNMPTN.

4. Sebagai sentra layanan sistem pengelolaan nomor induk siswa secara online.

Cara Cek NISN KU Online

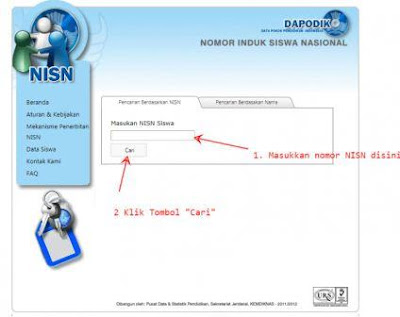

1. Pergilah ke situs “http://nisn.data.kemdikbud.go.id/page/data”

2. Setelah itu akan terbuka tampilan sebagai berikut :

3. Isikan Kolom “Masukan NISN Siswa” dengan NISN siswa anda

Jika anda sudah mengetahui NISN siswa anda. (Bagi anda yang ingin mencocokkan data siswa anda dengan data NISN Pusat).lalu klik “cari”.

Tetapi… jikalau anda ingin mencari NISN siswa anda menurut nama, maka klik lah Tab “Pencarian Berdasarkan Nama” menyerupai pada gambar dibawah:

4. Dikolom “Nama Siswa” silahkan ketikkan nama siswa anda, Kolom “Tempat Lahir” silahkan ketikkan kawasan lahir siswa anda, Kolom “Tanggal Lahir” silahkan ketikkan tanggal lahir siswa anda dengan format “tanggal/bulan/tahun, pola 31/12/2005“. Setelah itu klik tombol “Cari”.

Jika data yang anda ketikkan sesuai, maka akan muncul NISN siswa anda

APAKAH ANDA SUDAH TERDAFTAR NISN

berapa nomor induk siswa nasional saya? Untuk mengetahui NISN, silakan cek di sajian DATA SISWA atau klik pada link ini pada situs NISN, melalui tautan: http://nisn.data.kemdikbud.go.id/page/data Pengecekan sanggup dilakukan dengan 2 metode:

a. Memasukan nomor NISN bila sudah mempunyai atau

b. Memasukan nama lengkap (sesuai sertifikat lahir), kawasan lahir dan tanggal lahir bila belum mengetahui NISN.

BELUM MEMILIKI NISN, BAGAIMANA MENGURUSNYA?

a. Dianjurkan melaksanakan pengecekan lebih dahulu menyerupai langkah di atas.

b. Jika siswa tidak ditemukan, silakan download (unduh) Formulir Peserta Didik (F-PD) dan formulir A.1

c. pengajuan Nomor Induk Siswa Nasional (NISN) gres pada situs NISN http://nisn.data.kemdiknas.go.id

d. melalui sajian FORMULIR PENGAJUAN Mencetak formulir-formulir tersebut

e. Mengisi formulir-formulir tersebut secara manual

f. Menyerahkan kepada operator NISN/NPSN atau sekolah dimana siswa berasal

g. Bagi pihak sekolah sanggup mengirim formulir A.1. tersebut ke PDSP melalui email : pdsp@kemdiknas.go.id untuk diberikan NISN.

CARA MEMPERBAIKI BIODATA NISN BILA DATA TERTERA TIDAK SESUAI DENGAN AKTA KELAHIRAN

a. Silakan download (unduh) formulir A.3.

b. Pengajuan Perbaikan Biodata Siswa di situs NISN http://nisn.data.kemdiknas.go.id

c. pada sajian FORMULIR PENGAJUAN Mencetak formulir tersebut

d. Mengisi formulir tersebut secara manual

e. Menyerahkan kepada operator tingkat sekolah dimana NISN tersebut diterbitkan

f. Bagi sekolah, sanggup mengirimkan formulir yang sudah diperbaiki tersebut ke PDSP melalui email : pdsp@kemdiknas.go.id.

itulah beliau 2 cara mencari NISN ku supaya sanggup membantu dalam pekerjaan anda.